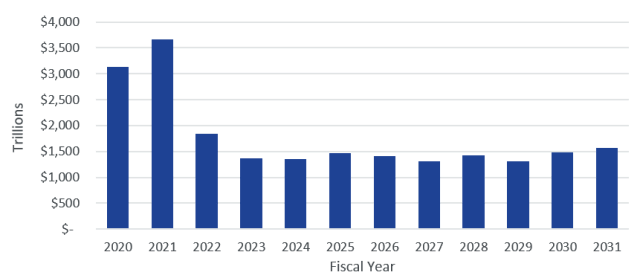

The United States Government is used to running deficits. In fact, the Federal Government has only had a surplus in 33 of the past 121 years since 1901, with the most recent surplus coming in 2001 at $130 billion. For comparison, in fiscal year 2022 the U.S. Federal Government spent $6.0 trillion, resulting in a deficit of $1.8 trillion for the year. Based on the most recent Budget of the U.S. Government published by the Office of Management and Budget, these deficits are expected to continue with proposed deficit spending of at least $1 trillion in each of the next 10 years.

U.S. Proposed Deficits

A significant portion, about 60% per year, of federal spending is on Mandatory Programs, which include Social Security ($1.2 trillion in 2022), Medicare ($766 billion in 2022), Medicaid ($571 billion in 2022) and other programs ($1.5 trillion in 2022). Most of these programs are indexed to inflation, which will result in significantly higher spending in 2023 as we face the highest inflation levels in 40 years.

With rising interest rates and rising debt levels, interest expense is projected to become a larger burden on the federal Budget. Within the next 10 years, interest expense on the federal debt is expected to approach $1 trillion, up from $305 billion in fiscal year 2022. In fact, the budget proposal has interest expense accounting for 11% of Federal Government spending in 2031, up from 5.1% in 2022.

U.S. Federal Budget

The continuous budget deficits that the Federal Government runs has led to a significant increase in the amount of outstanding Treasury securities. The total amount of outstanding U.S. Treasuries, including securities held by the Federal Reserve, has reached $31.2 trillion as of October 31, 2022. This is up from $23.3 trillion as of the end of 2019. As the size of the Treasury market grows, liquidity in the market becomes a concern.

Dealers that are responsible for providing liquidity to the Treasury market are under strict capital rule requirements that were put in place after the financial crisis of 2008. At the time these capital requirements were implemented, the Treasury market was about half of its current size. Given the sharp rise in outstanding Treasuries, dealers have not been able to keep up with the day-to-day trading demands of the larger market due to the capital requirements they must adhere to. This has led to higher volatility in the Treasury market and higher trading costs (wider bid/offer spreads). If regulators do not address this situation, volatility will likely increase, which could lead to a potential liquidity crisis in the Treasury market.

We believe that regulators are fully aware of the massively growing Treasury market. A possible outcome includes looser capital requirements for trading firms that are deemed liquidity providers for Treasuries. In addition, it is possible the Federal Reserve could become a liquidity provider as they have in the past (i.e., with quantitative easing). This is an area of the market we are keeping a close eye on, and believe that regulators and the Federal Reserve are too.

Liquidity is an important part of the Treasury market. While we do not expect liquidity to become an issue, if it does, yields could rise significantly, pushing bond prices lower. If this were to happen, we believe the Federal Reserve would do whatever it takes to stabilize the market. Nevertheless, we continue to believe that a laddered fixed income portfolio remains the prudent approach to a fixed income allocation.