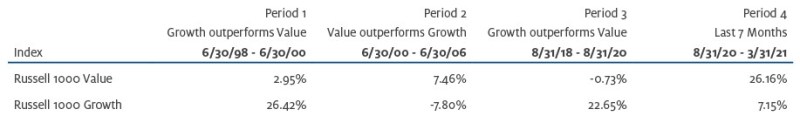

Value investors have had to be unusually patient for the last eight years. Growth indexes had significantly exceeded the value indexes, intensifying that advantage in the first eight months of 2020. Encouragingly, beginning in September 2020, value stocks have rebounded quite well relative to growth and outperformed by 19%, represented by the Russell 1000 Value return of +26.2% compared to the Russell 1000 Growth return of +7.2%, on the heels of encouraging vaccine data and the expected re-opening of economies around the world.

This occurred as concentration of the twenty largest stocks in the S&P 500 index declined from peak concentration levels in September 2020, paralleling a similar peak in early 2000, which saw subsequent outperformance for value stocks, as shown below.

S&P 500 Index: Combined Market Cap Weight of 20 Largest Stocks

Annualized Returns by Index

Over the last two quarters, characteristic of the early months of a value rebound, the stocks which have performed best have generally had greater leverage, more discounted valuations and lower profitability, as measured by their ROE or return on equity. This is quite common for deeper value, highly-leveraged stocks to have their strongest returns come in the initial stage of a market rebound, though their longer-term success often lacks sustainability. While the temptation to rush out and add deeply-cyclical stocks to a portfolio can be strong, we encourage investors to focus most of their equity portfolio on quality factors that will endure across a full market cycle, such as:

- Balance sheet strength with the ability to maintain dividend payments and, if needed, access to the debt markets given the high degree of economic uncertainly and business disruption.

- A proven management team with success at capital allocation. This would likely mean experience and success navigating the financial crisis in 2008 and 2009.

- Success in free cash flow generation and subsequent above average free cash flow margins.

Value Investing over Full Market Cycles

Through our internal research and conversations with external research firms, we have identified five periods within a typical market cycle. They are:

- Stage 1: Initial rebound from market trough and recession

- Stage 2: Expansion phase where economic and profit growth accelerates

- Stage 3: Sustainability period as the initial acceleration moderates

- Stage 4: Deceleration period where growth rates remain positive, but at a decelerating rate

- Stage 5: Recessionary period and the next trough

During each stage of the cycle, different factors can have a greater influence on which specific stocks fare the best. For example, in the latter periods of Stage 4 and certainly in Stage 5, a greater emphasis on earnings and sales consistency and less use of leverage are financial variables essential for downside protection. Simply look at the periods prior to both the 2008 and 2020 crisis for proof.

In contrast, in the Stage 1 initial rebound, companies with greater cyclicality, higher beta and greater dispersion of earnings and sales typically fare best. Often these are companies that have survived a recession and bear market, but have a lower conviction for their longer-term financial success. They subsequently experience short-term outsized gains during the earliest phases of recovery, which is the period we believe we have just experienced.

Identifying which stage of the cycle we are in and modifying holdings accordingly may temporarily lead to higher excess returns. Though the ability to correctly identify when the five stages of a cycle would turn would be enviable for any investor, we are skeptical of placing too much emphasis on successfully making such macro forecasts due to the high portfolio turnover that would result and the lost compounding opportunity spent courting less enduring and lower quality long-term assets. The portfolio management team I am part of utilizes investment processes that emphasize quality combined with lower turnover under the belief that patient capital in high-quality businesses will outperform. We believe that approach will prevail in the majority of the five stages of an investment cycle and, therefore, the full cycle. We believe quality has the bonus effect of mitigating risk of permanent impairment to capital for the patient investor interested in owning businesses, not renting them.